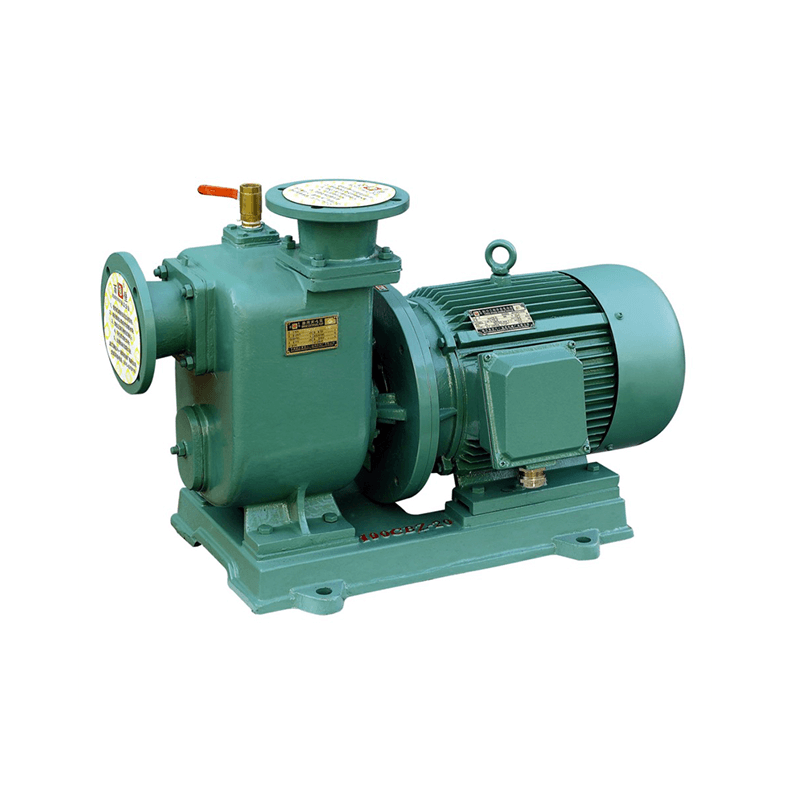

YE2 Electric Machinery Manufacturers Share the Overall Development Trend of the Industry

Faced with the current situation of oversupply in the automotive industry, banks should find high-quality customers in the "excess", lock in enterprises with technical patents, pay attention to their intellectual property rights, transform them into high-quality customers, and try to avoid the high credit risk of short-term profits of small enterprises.

For small and medium-sized enterprises, banks are encouraged to grant credit on the premise of controllable risk; besides various loans, banks can also introduce credit business such as letter of credit, bill acceptance and so on; in order to improve the quality of loans, banks can relax the scope of mortgage. For example, banks can pledge intellectual property rights such as trademark exclusive rights, patent rights, copyright, mortgage of personal property, pledge of small business owners or major shareholders, personal property and the guarantee of small business owners or major shareholders. The joint account guarantee of the business owner, the guarantee of economic consortium, the use of export credit insurance instead of guarantee, etc. Reduce risk to a great extent.

According to the characteristics of small business loans, we can evaluate the overall quality of credit granted by small automobile enterprises, and abandon the traditional single loan and single household loan evaluation methods. At the same time, we should adjust the conditions of credit audit, emphasizing on-site investigation, collecting non-financial information, and not rely solely on financial statements and guarantees. At the same time, it is suggested that banks adjust the credit evaluation criteria, require the establishment of credit scoring system for small enterprises, and highlight the personal credit evaluation of owners or major shareholders of small automobile enterprises.

In terms of product structure and varieties, special derivatives will have greater development because of the need to save energy and meet the needs of supporting new industrial products. For example, high efficiency permanent magnet synchronous motor (PMSM) will develop rapidly with renewable energy, wind energy, solar energy, tidal energy, natural gas and other new energy sources. In addition, the demand for medium-sized high and low voltage motors and high-voltage high-power submersible pumps is also growing rapidly. Therefore, it is suggested that banks should focus on supporting these enterprises.

In addition, the merger of emerging private enterprises and state-owned enterprises has achieved rapid development in the way of "backdoor production".

From the point of view of key regions, the provinces and cities with high output of small and medium-sized motors are Shandong, Jiangsu, Hebei, Shanghai, Zhejiang, Guangdong, Liaoning and other coastal areas. It is suggested that banks adjust the direction of credit investment and invest capital in these areas.

For small and medium-sized enterprises, banks are encouraged to grant credit on the premise of controllable risk; besides various loans, banks can also introduce credit business such as letter of credit, bill acceptance and so on; in order to improve the quality of loans, banks can relax the scope of mortgage. For example, banks can pledge intellectual property rights such as trademark exclusive rights, patent rights, copyright, mortgage of personal property, pledge of small business owners or major shareholders, personal property and the guarantee of small business owners or major shareholders. The joint account guarantee of the business owner, the guarantee of economic consortium, the use of export credit insurance instead of guarantee, etc. Reduce risk to a great extent.

According to the characteristics of small business loans, we can evaluate the overall quality of credit granted by small automobile enterprises, and abandon the traditional single loan and single household loan evaluation methods. At the same time, we should adjust the conditions of credit audit, emphasizing on-site investigation, collecting non-financial information, and not rely solely on financial statements and guarantees. At the same time, it is suggested that banks adjust the credit evaluation criteria, require the establishment of credit scoring system for small enterprises, and highlight the personal credit evaluation of owners or major shareholders of small automobile enterprises.

In terms of product structure and varieties, special derivatives will have greater development because of the need to save energy and meet the needs of supporting new industrial products. For example, high efficiency permanent magnet synchronous motor (PMSM) will develop rapidly with renewable energy, wind energy, solar energy, tidal energy, natural gas and other new energy sources. In addition, the demand for medium-sized high and low voltage motors and high-voltage high-power submersible pumps is also growing rapidly. Therefore, it is suggested that banks should focus on supporting these enterprises.

In addition, the merger of emerging private enterprises and state-owned enterprises has achieved rapid development in the way of "backdoor production".

From the point of view of key regions, the provinces and cities with high output of small and medium-sized motors are Shandong, Jiangsu, Hebei, Shanghai, Zhejiang, Guangdong, Liaoning and other coastal areas. It is suggested that banks adjust the direction of credit investment and invest capital in these areas.